Bảo hiểm xe máy VBI có tốt không? Có nên mua không?

VBI motorbike insurance is one of the types of insurance provided by Vietinbank to vehicle owners participating in traffic in Vietnam. With many insurance options on the market, choosing a suitable and reliable product is important.

In this article, we will evaluate the features and quality of Vietinbank motorbike insurance (VBI) to help you make the best decision.

What is VBI motorbike insurance?

Motorcycle insurance is an insurance product of Vietnam Joint Stock Commercial Bank for Industry and Trade (Vietinbank) for motorbike owners. This product includes civil liability insurance (CIT) and other ancillaries such as accident insurance, theft insurance, fire and explosion insurance, vehicle body insurance, vehicle occupant insurance, etc.

VBI motorbike civil liability insurance protects motorbike owners from legal risks when causing damage to third parties. Accordingly, Vietinbank will pay compensation arising from the motorbike owner causing damage to a third party, including damage to people and property.

The benefits of using VBI Automobile and Motorcycle Civil Liability Insurance include:

- Receive the electronic certificate at the email/SMS address you registered with. When you need to present documents, you can provide an electronic certificate or code for traffic police to look up information.

- In case of an accident, you can take photos of the scene and the vehicle's damage, then declare compensation directly on the My VBI application.

- Receive compensation quickly through the My VBI application within just 05 working days from the time the complete and valid documents are received by VBI.

- Buy VBI Automobile and Motorcycle Civil Liability Insurance online anytime and anywhere, with many attractive payment methods.

From March 10 to May 10, 2023, get a free VinID Voucher worth 10,000 VND when customers directly buy Motorcycle Civil Liability Insurance with Passenger Accident Insurance worth a minimum of 20,000 VND at MyVBI Website and App .

Customers who purchase motorbike civil liability insurance with passenger accident insurance worth at least 20,000 VND during the promotion period will have the opportunity to participate in the special lottery program with gift value. Super attractive up to 30 million VND.

- 01 Apple Watch Series SE 2 GPS 40mm aluminum bezel and rubber band

- 01 Sony SRS-XE200 Bluetooth Speaker

- 05 shopping vouchers 300,000 VND

Buy VBI motorbike insurance here

Find out details of VBI motorbike civil liability insurance

1. Subjects of application

This product applies to individual motorbike owners, organizations and businesses who need to protect their motorbikes. Applicable subjects also include drivers with valid driving licenses and using motorbikes within the territory of Vietnam.

In addition, applicable vehicles are motorbikes manufactured within 15 years by the time of insurance. In case the motorbike is being used for commercial, business or rental purposes, VBI motorbike civil liability insurance will not be applied.

In short, the applicable subjects of VBI motorbike insurance include individual motorbike owners, organizations, businesses and drivers with valid driving licenses who are using motorbikes manufactured within 15 years. up to the time of insurance, meets traffic safety requirements.

2. Insurance premiums

|

Insurance fee must be paid |

|

| Electric motorbike | 60,500 VND |

| Motorcycles under 50cc | 60,500 VND |

| Motorcycles over 50cc | 66,000 VND |

|

Insurance for vehicle assistants and passengers |

|

|

Insurance benefits |

Annual fee |

| 10 million/person/case | 20,000 VND/year |

| 20 million/person/case | 40,000 VND/year |

| 30 million/person/case | 60,000 VND/year |

3. Level of insurance liability

The level of insurance liability of VBI motorbike insurance is regulated according to the provisions of law on civil liability insurance of road motor vehicle owners. Accordingly, VBI's maximum insurance liability is 50 million VND for each accident and no more than 100 million VND for each insurance year.

|

Insurance liability level |

Amount |

| For human damage caused by motor vehicles | 150 million/1 person/1 accident |

| For property damage caused by 2-wheeled, 3-wheeled motorbikes, mopeds and similar motor vehicles | 50 million/1 accident |

| For property damage caused by cars, tractors, construction trailers, agricultural and forestry motorbikes and other special vehicles used for security and defense purposes. | 100 million VND/ 1 accident. |

However, the specific level of insurance liability will depend on the type of vehicle, location of stay, purpose of use and other factors. VBI also offers insurance packages with different levels of liability to suit customer needs.

In addition, VBI also provides additional insurance packages such as accident insurance for motorbike drivers, motorbike theft insurance, motorbike fire and explosion insurance, helping customers increase protection for their motorbikes. me.

4. Insurance exclusions

Insurance exclusions are situations or conditions in which insurance does not cover or does not apply to the risks occurring. VBI motorbike insurance exclusions include:

- Intentional act of causing damage by the vehicle owner, driver or person suffering damage. The driver who caused the accident intentionally fled without fulfilling the civil responsibilities of the vehicle owner or motor vehicle driver.

- Driving without a Driver's License or a Driver's License that is not suitable for a type of motor vehicle that requires a Driver's License. In case a driver is deprived of the right to use a driver's license for a limited or indefinite period of time, he or she is considered to not have a driver's license.

- Damage causes indirect consequences such as: reduction in commercial value, damage associated with the use and exploitation of damaged assets.

- Damage to property stolen or robbed in an accident.

- War, terrorism, earthquake.

- Accidents occur when the driver does not provide all the necessary information and documents to the insurance company upon request.

These exclusions, whether or not supplemented accordingly, are clearly listed in the insurance contract, and events occurring within the scope of these exclusions will not be entitled to any compensation from insurance.

Therefore, before signing an insurance contract, you need to carefully read the terms and exclusions to clearly understand the scope and limitations of the insurance product you are purchasing.

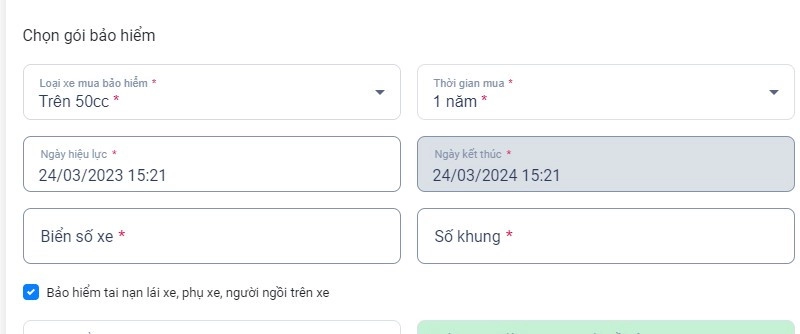

5. Validity of VBI motorbike insurance

VBI's motorbike insurance validity is the time the motorbike owner is protected by Vietinbank's insurance policy. The effective date of the Insurance Certificate is specifically stated on the Insurance Certificate but must not be before the time the motor vehicle owner pays the full insurance premium.

When registering online, the default end date is 1 year later

When registering online, the default end date is 1 year later

The current VBI application period is 1 year from the effective date. During this time, vehicle owners are protected in case of traffic accidents or other risks related to motorbikes.

If after the end of the validity period you want to continue, you can extend the insurance contract with Vietinbank. This extension will be done before the validity period of the current insurance contract ends.

If the car owner does not renew the insurance contract or does not buy new insurance, then of course, the car owner will have to bear the responsibility and costs incurred if any unwanted situations occur.

Is VBI motorbike insurance good? Should I buy it?

According to the provisions of the Road Traffic Law and Decree 03/2021/ND-CP, motorbike owners must participate in civil liability insurance of motor vehicle owners to be allowed to circulate on the road. The purpose of this type of insurance is to compensate people for personal and property damage caused by the vehicle owner in the event of a traffic accident.

VBI car insurance is a type of insurance worth considering

VBI car insurance is a type of insurance worth considering

Buy VBI motorbike insurance here

VBI motorbike insurance has the following advantages:

- Competitive insurance premium: only from 66,000 VND/year for a motorbike.

- Buying and selling procedures are quick and convenient: customers can buy insurance online via website, Zalo, mobile app or e-commerce platforms; or through VBI transaction points nationwide.

- Professional and dedicated customer service: VBI has a team of consulting and customer support staff 24/7 via hotline 19001566; as well as quick and transparent complaint handling and compensation payments.

- Service quality is confirmed: VBI is a reputable insurance company established in 2008; is a member of VietinBank Group – one of the leading banks in Vietnam; has been granted a license to conduct non-life insurance business; and has been trusted and highly appreciated by customers.

By purchasing VBI motorbike insurance, you not only comply with the law, but also feel secure when participating in traffic; as well as contribute to building a safe and civilized society.

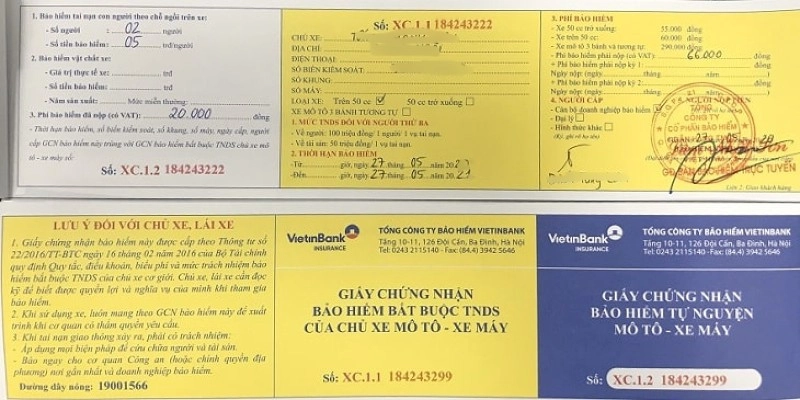

Sample Vietinbank motorbike insurance certificate

Vietinbank motorbike insurance certificate is proof that you have purchased motorbike insurance from Vietinbank. On this certificate there will be basic information about the car owner, motorbike and information about the insurance contract.

- Information about the car owner includes the car owner's name, ID/CCCD/Passport number, address, phone number and email.

- Information about motorbikes includes license plate number, vehicle type, frame number, engine number and year of manufacture.

- Information about insurance contracts includes contract start and end dates, insurance premiums, and contract terms and conditions.

To receive a Vietinbank motorbike insurance certificate, you need to register for VBI motorbike insurance and pay the insurance fee. After completing these procedures, you will receive Vietinbank's motorbike insurance certificate by mail or email.

Below is an illustration of VBI's motorbike insurance product

Real photo of VIB motorbike insurance

Real photo of VIB motorbike insurance

Look up Vietinbank electronic motorbike insurance certificate

The Vietinbank electronic motorbike insurance certificate lookup feature helps customers save time and effort in looking up information about their motorbike insurance. At the same time, this feature also helps customers check and compare information with traditional insurance certificates to ensure the accuracy and completeness of the information.

The steps are as follows:

- Step 1: Visit https://tracuu.evbi.vn/

- Step 2: Select Search Document Type

- Step 3: Select Certificate (Motorcycle Insurance)

- Step 4: Enter ID card/Passport

- Step 5: Enter the license plate number

- Step 6: Enter the Verification Code, then click Lookup to view information

See more: How to buy insurance delivered at home

Frequently asked questions

1. How is the insurance contract sent?

Vietinbank's insurance contract will be sent to the customer via the registered address within 5 to 7 working days after the customer completes the registration and pays the insurance fee.

When customers buy car and motorbike civil liability insurance products from VBI – Vietinbank Insurance, the electronic certificate of civil liability insurance will be sent by email/SMS to customers. In addition, You can immediately download the electronic certificate on VBI's lookup page at https://tracuu.evbi.vn/ or download the My VBI app to look up the certificate.

2. What are the penalties for not having motorbike insurance?

According to point a, Clause 2, Article 21 of Decree 100/2019/ND-CP (amended by Clause 11, Article 2 of Decree 123/2021/ND-CP) stipulates: Drivers of motorbikes, mopeds, Vehicles similar to motorbikes and vehicles similar to mopeds that do not have or do not carry a valid certificate of motor vehicle owner's civil liability insurance (motorcycle insurance) fined from 100,000 VND to 200,000 VND.

3. How to contact VBI insurance?

Hotline: 1900.1566

E-mail: [email protected]

Address: 10th -11th Floor, 126 Doi Can Building, Ba Dinh District, Hanoi City, Vietnam

4. How to claim compensation when an accident occurs?

When an accident occurs, take photos of the scene and vehicle damage and declare compensation directly on the My VBI app. Receive super-fast compensation via the My VBI app within 05 working days from when VBI receives a complete and valid dossier.

With many advantages such as flexibility, reasonable costs and professional staff, VBI is becoming one of the reliable partners of drivers. If you are looking for reliable motorbike insurance, you can consider VBI motorbike insurance!